Business Outline

Q1 What does PRONEXUS do?

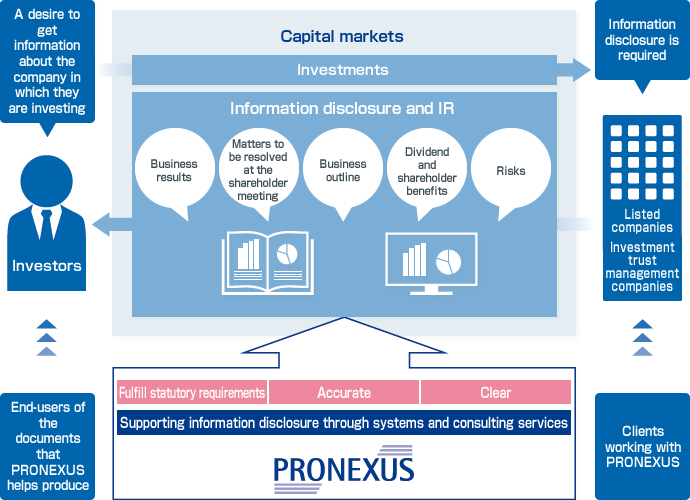

A1 We provide back-office support for information disclosure to investors by listed companies and investment trust management companies.

PRONEXUS specializes in providing practical support to listed companies and financial instruments management companies for the preparation of disclosure and other materials for investor relations (IR) activities.

Q2 What types of support does PRONEXUS provide?

A2 We provide system and consulting services to help streamline disclosure operations.

Some 60% of the listed companies in Japan use PRONEXUS WORKS, our system supporting preparation of disclosure documents.

PRONEXUS employs about 80 consulting experts who specialize in disclosure. They check clients' documents and offer advice, as well as create a range of manuals and host seminars. PRONEXUS also provides outsourcing services for certain parts of its clients' disclosure operations.

Q3 What aspects of PRONEXUS' business do individual investors see?

A3 Some of the better-known aspects include earnings reports and securities reports uploaded to company websites. For shareholders meetings, we also assist with convocation notices, and for banks and securities companies we offer support for creating sales tools for investment trusts.

Business Results

Q4 What are PRONEXUS' latest business results?

A4 Consolidated revenue reached a record high and surpassed 30,000 million yen for the first time

In the fiscal year ended March 2024, consolidated revenue was approximately 30.1 billion, consolidated operating profit was approximately 2.4 billion and net profit attributable to owners of the parent was approximately 1.8 billion.

Q5 What is PRONEXUS' business performance for current fiscal year?

A5 For the fiscal year ending March 31, 2025, we forecast revenue of 31.0 billion yen and operating profit of 2.5 billion yen.

Shareholder return

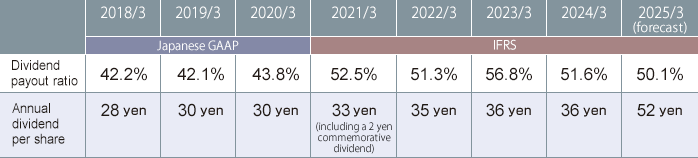

Q6 What is PRONEXUS' dividend per share?

A6 The expected full-year dividend for the fiscal year ending March 2024 will be 36 yen per share.

The Company believes that returning profits to shareholders is a vital issue facing company management, and is taking a series of measures corresponding to our belief. The Company's basic dividend policy is to conduct the stable, continuous payment of dividends, taking a comprehensive evaluation of business performance and the business environment into account. The Company's standard for the dividend payout ratio is 50% or higher.

Based on a policy of providing stable dividends, for the fiscal year ending March 2025, the Company plans to pay ordinary annual dividends of 36 yen per share (18 yen at the second quarter-end and 18 yen at the year-end), in addition to a special dividend of 16 yen per share (8 yen at the second quarter-end and 8 yen at the year-end) funded by a portion of the gain on sale of investments accounted for using equity method generated by the transfer of shares of Mitsue-Links Co., Ltd. As a result, the Company forecasts annual dividends of 52.00 yen per share (26.00 yen at the second quarter-end and 26.00 yen at the fiscal year-end).

The Company will continue to consider it as a shareholder return measure, while also taking into consideration the balance between investment in equipment and human resources, and growth investment including M&A.

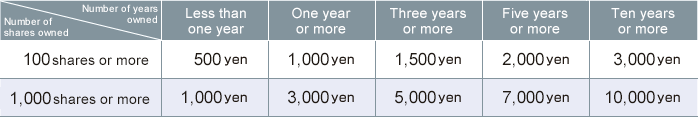

Q7 What benefits does PRONEXUS offer shareholders?

A7 We provide shareholders with QUO prepaid cards based on the number of years and number of shares owned.

Each year, we offer a special benefit to shareholders listed on the shareholder registration who own at least 100 shares as of March 31.