Revenue hits a new record high, based on the first half of the fiscal year

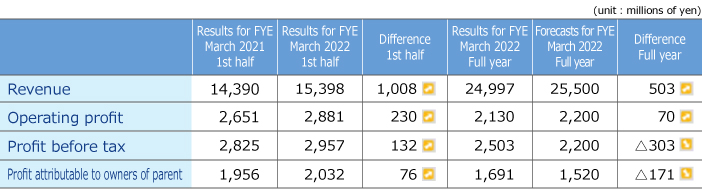

In the first six months, a stronger move to enhance information provision to investors driven by revisions to Japan’s Corporate Governance Code in June, as well as an increase in financing and IPOs from the recovery in the securities market of Japan and the J-REIT market compared to the same period of the previous fiscal year led to increased orders for related products. As a result, consolidated revenue in the first six months was 15,398 million yen, an increase of 1,008 million yen, or 7.0%, year on year.

Concerning profits, while outsourcing expenses as well as labor costs and personnel expenses associated with the strengthening of structures increased, due to efforts to control expenses, operating profit was 2,881 million yen, an increase of 230 million yen, or 8.7%, year on year. Profit before tax was 2,957 million yen, an increase of 132 million yen, or 4.7%, year on year, and profit attributable to owners of parent was 2,032 million yen, an increase of 76 million yen, or 3.9%, year on year.

President and Representative Director

Sales performance by business

<Listed companies disclosure-related business>

Regarding shareholder convocation notices, one of our mainstay products, in addition to existing efforts to convert notices to color printing and expand the information that they provide, the increased number of individual shareholders led to increased unit prices for orders. Furthermore, with greater needs for operational streamlining, increased revenue in outsourcing services for the preparation of disclosure documents contributed to sales, and orders for products related to financing and IPOs increased with the recovery in the securities market of Japan. As a result, revenue of the listed companies disclosure-related business was 7,218 million yen, an increase of 272 million yen, or 3.9%, year on year.

<Listed companies IR-related, etc. business>

Against the backdrop of the response to the revised Corporate Governance Code, orders for English translation services increased. Orders for visualization services for shareholders’ meetings, which contracted due to the COVID-19 pandemic in the same period of the previous fiscal year, as well as orders for virtual shareholders’ meeting support services, also increased. As a result, revenue of the listed companies IR-related, etc. business was 4,080 million yen, an increase of 464 million yen, or 12.8%, year on year.

<Financial instruments disclosure-related business>

As the J-REIT market continued to rise entering this year, financing and IPOs increased, and the issuance of foreign bonds improved compared to the same period of the previous fiscal year, leading to increased orders for related products. Furthermore, new orders increased for various sales promotion tools for financial institutions. As a result, revenue of the financial instruments disclosure-related business was 3,566 million yen, an increase of 283 million yen, or 8.6%, year on year.

<Database-related business>

In the database-related business, although we received orders from new customers, there were some cancellations and decreases in unit prices during contract renewals for existing customers. As a result, revenue of the database-related business was 534 million yen, a decrease of 11 million yen, or 2.0%, year on year.

Furthermore, to maximize Group synergies, we reorganized the Company’s database business by transferring it to our consolidated subsidiary I-N Information Systems, Ltd. through a corporate split-off involving a merger by absorption (May 2021).

Full-term earnings outlook remains unchanged

Both sales and profit showed solid growth, exceeding our initial forecast for the second quarter, announced in May 2021. On the other hand, about 40% of the Group's consolidated revenue is from nonregular products and services that are affected by market trends, such as IPO/financing and services for financial products. We have conservatively factored in future sources of uncertainty, though we have maintained our initial forecast for the full fiscal year. Looking ahead to the post-COVID world, we will invest strategically and assign human resources as needed to improve the continuity and profitability of our operations.

I would like to ask all our shareholders for their continued support and encouragement.

Note: The Company has adopted International Financial Reporting Standards (IFRS) from the Securities Report for the fiscal year ending March 31, 2020.