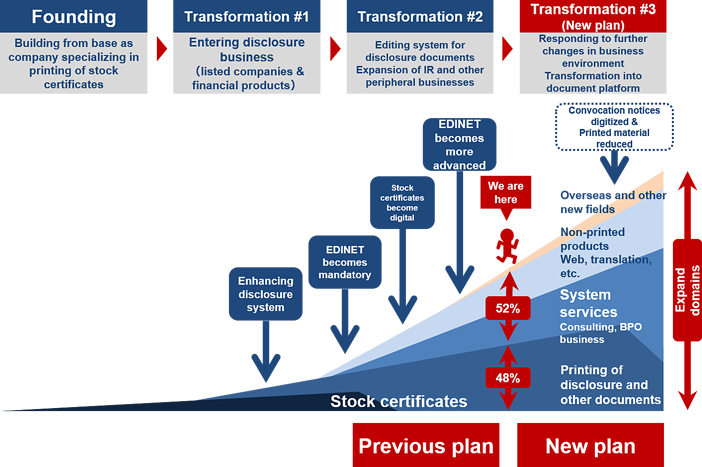

1.Background of New Medium-term Management Plan 2021:

History of PRONEXUS's Businesses

■Continuous growth by expanding business domains in response to changes in business environment

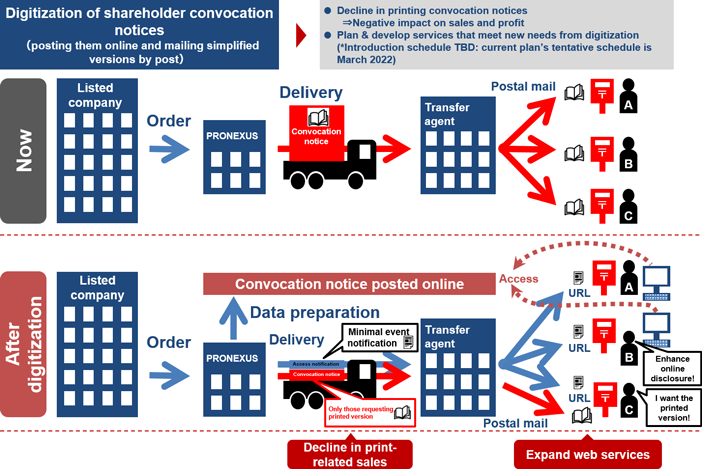

2.Background of New Medium-term Management Plan 2021:

Future Changes in Business Environment (1)

■Biggest change in business environment: Digitization of shareholder convocation notices

- * Currently, a revision to the Companies Act is being reviewed according to the rules of the digitization system. This revision is only a draft at the time of this new plan was released. The details of the institutional design and the timing of its introduction are still undecided.

3.Background of New Medium-term Management Plan 2021:

Future Changes in Business Environment (2)

■Our response to other changes in business environment

- Advancement of specifications for XBRL used in the Electronic Disclosure for Investors' NETwork (EDINET)

- Expansion of information stated on the annual securities report

- Consideration of integrated disclosure of business reports

- Digitization of disclosure documents in the area of financial instruments disclosure and advance of improvements to the ease of understanding of explanatory materials

- Growing needs for improvements in operational efficiency along with work-style reforms

- Evolution of online IR services along with online posting of disclosure information

- Arising of new disclosure and IR needs as market structural reforms advance at the Tokyo Stock Exchange

Most important management issue as to respond to these market environmental changes and transform them into growth potential.

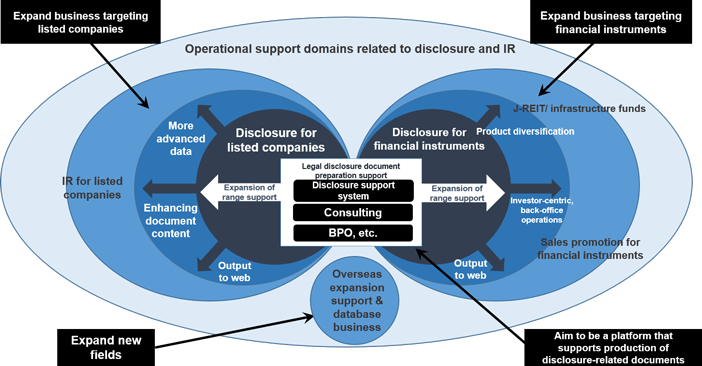

4.Concept of New Medium-term Management Plan 2021

■New plan carries on "expansion of range of customer support" from previous medium-term management plan

■Further system + consulting expansion, aiming to be "platform business" with disclosure-related document production as core

5.Key strategies in the of New Medium-term Management Plan 2021

1Establishment of customer support structure for the era of digitization

Background

- Digitization of shareholder convocation notices

- Growing demand for web services

Key strategies

- Establish new services that improve the convenience of shareholders

(support a reduction in the workload) - Enhancement of web services along with digitization

(providing peripheral support for areas)

Providing pioneering services that meet regulation changes, increasing needs, and IT environment development

2System expansion and growth into a document platform

Background

- Advancement of XBRL

- Enhancement of disclosure information

- Advance of paperless operations in the field of investment trusts

- Growing needs for improvements in operational efficiency along with work-style reforms

Key strategies

- Innovation the functions of PRONEXUS WORKS, a system for preparing disclosure documents, and work to increase orders for the WORKS-i and WORKS-Core optional services.

- Expand the functions of the FDS investment trust fund document preparation system

- Strengthen consulting services and BPO services

Supporting customers' practical business through system services and consulting

3Continuation and further evolution of domain expansion from the previous plan

Background

- Growing demand for dialog with investors along with the introduction of the Corporate Governance Code

- Market structural reforms at the Tokyo Stock Exchange

- Growing needs among Japanese companies moving into Asia

Key strategies

- Further strengthen structures for the growth drivers (web services, translation services, and visualization services for shareholders' meetings)

- Promote market expansion for the database business.

- Strengthen the operational structure of the overseas expansion support business

Expand domains beyond market needs

4Establishment of internal foundations for both expanding business domains and increasing revenue

Background

- Increase in orders

- Profit targets not achieved in the previous plan

- Work-style reforms at the Company

Key strategies

- Promote fundamental operational reforms internally and achieve both strengthened customer support and improvements in productivity

- Strengthen profit management in addition to the efforts above and aim to increase profits

- Strengthen internal resources through means such as human resources development in response to business domain expansion

- Promote the use of external resources including M&As and capital and business tie-ups

Control of cost increases from system enhancements through productivity improvements

5Financial strategy

Background

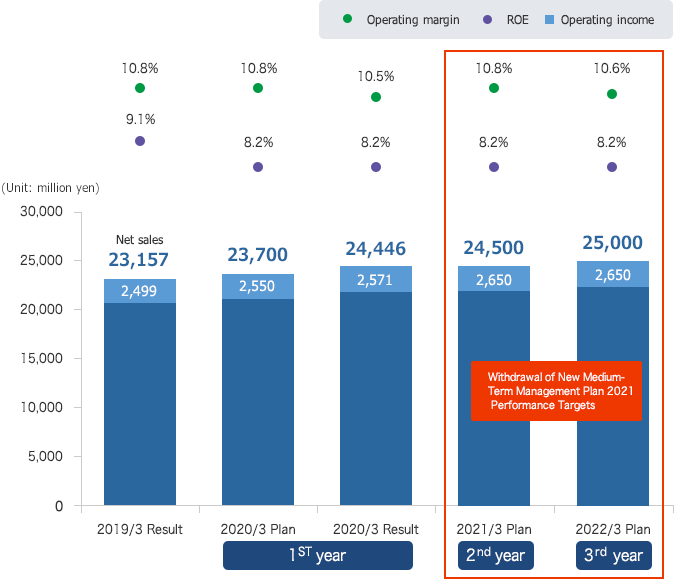

- ROE of 9.1% in the fiscal year ended March 31, 2019

- Total shareholder return ratio of 68.4% in the fiscal year ended March 31, 2019

Key strategies

- Improve profitability and maintaining high shareholder returns (Raise the dividend payout ratio to 40% from 30%)

Position improvement of capital efficiency as an important management issue

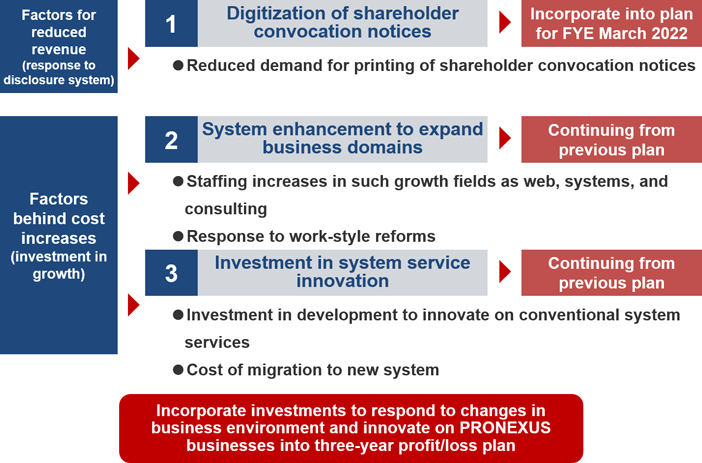

6.Prerequisites for Profit / Loss Plan of New Medium-term Management Plan 2021

7.Quantitative Targets in the New Medium-term Management Plan 2021

■Targets for net sales, operating income, operating margin and ROE

Withdrawal of New Medium-Term Management Plan 2021 Performance Targets

As announced on May 14, we have not yet decided on the earnings forecast for the fiscal year ending March 2021. As a result, the performance targets for the second and third years of our New Medium-Term Management Plan 2021 will be temporarily withdrawn. We will disclose the performance target when it becomes possible to revise the earnings forecasts.

Notice Concerning Withdrawal of New Medium-Term Management Plan 2021 Performance Targets

Consolidated full-year earnings forecasts for the fiscal year ending March 31, 2021

As disclosed on August 28, 2020, we believe that the impact of COVID-19 on sales will be limited, so our forecast for consolidated full-year revenue is 24.0 billion yen, 500 million yen less than the initial figure from our medium-term management plan. At the same time, operating profit is forecast to decrease 650 million yen from the previous fiscal year to 2.0 billion yen due to strategic and human resource investments.

(Notice Concerning Earnings Forecast for the Fiscal Year Ending March 31, 2021)